What Does a Title Company Do?

July 28, 2022

Buying a property is not as simple as it may seem. Contrary to popular belief, it's not as easy finding the right property, settling on a price, and just placing your signature to seal the deal. A long and very intricate process —filled with paperwork and formalities— takes place to properly and securely close the real estate transaction.Through this article, we intend to explain in detail what a title is, our role as a title company in the closing process, and what we can offer through our title and escrow company to help close the deal as quickly and smoothly as possible.

But first, it's important to understand what a title is —and what it's not.

But first, it's important to understand what a title is —and what it's not.WHAT IS A TITLE?

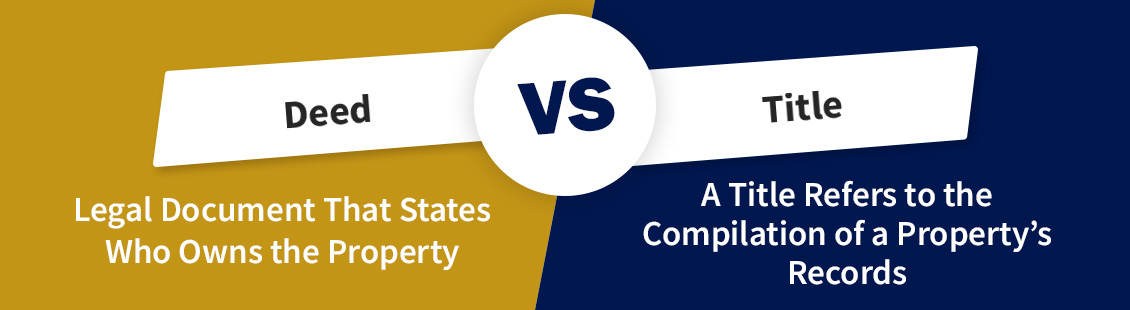

A title refers to the compilation of a property's records. They determine legal ownership and rights to use and sell —partial or complete.When buying a property, it's crucial to know whether the seller can legally and fully transfer the property. In other words, it's free of errors and liens or encumbrances, and no one else can later claim debt or ownership over the property.

WHAT'S NOT A TITLE?

A title is not the same as the property's deed. Both are commonly mistaken but have clear differences.The deed is the legal document that states who owns the property. Contrary to the title, it does not hold any further information that could point to future claims from previous owners —encumbrances—, or if it's free and clear of any error or debt that may put at risk your right to own.

WHAT IS THE ROLE OF A TITLE COMPANY?

As your title company, we will perform a series of tasks in order to ensure the property you intend to buy is free and clear to own and to protect you and your lender —when applicable— from claims or liens by previous owners or other parties.Title Search

The first thing we do is conduct a title search. Its goal is to verify property ownership and thus confirm that the seller has the right to truly and fully transfer it to the buyer. A title search includes:- Public records are thoroughly researched to uncover possible errors, liens or encumbrances. Why is it important? Errors on public records can occur, such as an unrecorded property release after a paid-off mortgage that can result in a lien on the property. Unpaid taxes, contract work done on the property, or HOA payments may also be discovered. Discovering these defects may protect you from liability.

- Boundaries, legal description, and easement of property are verified. Why is it important? You may find the shed was built beyond the property line, or maybe the neighbor has an easement to use your driveway in order to access his property. Verifying these aspects may avoid you a possible dispute or claim with the neighbors over property lines or right to use.

- Documents are analyzed and all necessary investigations are made to cast aside any possibility of fraud —forgery and impersonation— or the existence of missing heirs. Why is it important? There are people with malicious intent out there, looking to scam you out of your hard-earned money. There's also the possibility that an unknown heir shows up to claim his part. The proper investigations can let you pull out of a fraudulent deal or help the seller and other heirs reach an agreement to sell.

Title Insurance

Once the title search is done and no defects or encumbrances were found —or if found, were settled— we will issue title insurance for your property. Although every step was taken in the title search process to ensure the property you're buying is free and clear of any problems due to its history, there's always the chance something may arise. We will protect you from any financial loss or cost with title insurance.

Although every step was taken in the title search process to ensure the property you're buying is free and clear of any problems due to its history, there's always the chance something may arise. We will protect you from any financial loss or cost with title insurance.If you're buying by taking out a mortgage on the property, lender's insurance will be required. This policy protects your lender's interest on your property by covering the amount given on loan until it's fully paid off. As a buyer, you'll be responsible for paying for your lender's insurance.

Escrow

Not all title companies handle escrow, however, at Key Title & Escrow we are more than capable of setting up and managing an escrow account to facilitate your closing. As an escrow company, we serve as a neutral third party between you —the buyer— and the seller, that holds the funds and documents related to the closing of the property until all obligations are met.Oversee the Closing Process

Our last responsibility as your title company is to oversee and accompany you throughout the closing process.To do so, we will review and guide you through all the paperwork, ensuring the deed, seller's affidavit, bill of sale, transfer taxes, loan notes, mortgage, and all other documents are in order. Once the closing process is over, we file all of the paperwork to legally record the transaction.

WHY CHOOSE KEY TITLE & ESCROW AS YOUR TITLE COMPANY?

When choosing a title company you want to look for one that's close to you, has a great reputation, and has the experience and resources to ensure a quick and hassle-free closing. At Key Title & Escrow we've served the real estate industry for over 24 years, gaining a reputation for efficient, stress-free real estate closings. We have the resources to serve you all throughout the state of Florida and even on weekends and after hours.

At Key Title & Escrow we've served the real estate industry for over 24 years, gaining a reputation for efficient, stress-free real estate closings. We have the resources to serve you all throughout the state of Florida and even on weekends and after hours.Plus, we offer an array of services, such as escrow and state-wide notary services, that let us comprehensibly handle your closing from start to finish.

If you found this article useful and are looking for a title and escrow company that can handle every step of the closing process for you, be sure to give us a call at (305) 235-4571 or toll-free at (800) 547-0006. You can also fill out the Contact us form on this page and we will get back to you as soon as we can. We will be more than happy to put our experience at your disposal.